Fractional Investing is a great way to get started investing in the stock market.

This site, FractionalInvesting.com, will tell you all you need to know about fractional investing and help you can get started investing in the stock market.

Definition of Fractional Investing:

Fractional Investing is simply buying a certain dollar amount of stock instead of buying a certain number of shares. Since you are investing a fixed dollar amount, most of the time you will end up buying a fraction of a share.

Lately fractional investing has become a popular way for young people and those just getting started investing in the stock market because they can invest small amounts (like $10) in the stocks or companies they love.

Example of Fractional Investing:

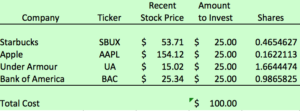

The idea is that if you are just getting started investing and only have a small amount to invest, like $100 per month, and you have 4 favorite companies, with fractional investing you could invest $25 in each of those companies each month.

Say you love Starbucks, Apple, Under Armor and Bank of America and you want to start investing in those companies. You could open a fractional brokerage account (more on that below) and tell the broker to withdraw $100 from your checking account on the 15th of every month and buy $25 worth of each of those 4 stocks.

In the chart above, you see that Starbucks price was $53.71 at the time the trade is made. If we are spending $25 on Starbucks then $25 divided by the share price of $53.71 is .4654627 shares.

The broker would take the funds out of your checking account, and make the purchase based on the current market price of each of the stocks. The chart above shows the calculations of shares purchased based on the prices listed.

Each month you would spend $100 but the actual number of shares you would buy of each stock would change based on the price at the time the trade is made.

Advantages of Fractional Investing

Here are some of the advantages to Fractional Investing:

- You can get started with very little cash

- Opening an account is fast and easy

- The stock market, on average, earns 8% a year so buying stocks is generally the preferred investment over a long term period. Investing your cash in a savings account generally earns 3%.

- Fractional Investing is using dollar cost averaging. This means that you will naturally buy fewer shares when the price is higher and more shares when the price is lower so you average price should be lower than if you just bought a fixed number of shares per month.

Disadvantages of Fractional Investing

Here are some of the disadvantages of Fractional Investing:

- Beware of fees! Make sure you know how your broker is charging. If they charge $5 per month and you are only investing $100, then you are losing 5% of your money.

- Use a reputable broker. There are lots of startups offering fractional investing but for the most part these firms are not profitable and you have to be comfortable that your money is safe.

- Make sure you know how to sell your stocks and get your cash back. If there is an emergency and you need your money back, make sure you understand how much the broker charges to sell the shares and make sure you understand how many days it will take to get your money back into your bank account.

Fractional Investing Trends

Twenty years ago most stock trades were made in “round lots” of 100 shares. Brokers charged higher commission for “odd lot” trades, or trades that weren’t in multiples of 100 shares. With the launch of the web and discount brokers in the late 1990s, commission rates came down and the brokers eventually moved towards flat-fee stock commissions regardless of the number of shares.

But with the fear of recurring stock market crashes and distrust of “Wall Street” and the whole financial services sector, many people have hesitated opening brokerage accounts and putting their money in something they don’t fully understand.

With the recent surge in interest in financial literacy and financial education, coupled with advances in technology, new brokers started popping up offering fractional investing as a way to coax people into the market. These fractional brokerages have come up with unique ways to get people to invest.

One example is appealing to customers brand loyalty and encouraging customers to “invest in their favorite brands” or “buy what they know.” These brokerage companies offer easy to use websites and attractive mobile apps that allow users just to click on the logos of the companies in which they want to start investing.

Another example of how these start-up fractional investing companies have attracted new customers is by encouraging people to “round up” their transactions and start investing with their loose change. Suppose your morning Starbucks coffee and muffin cost $4.05 each morning. Why not round that up to $5.00 and have that extra 95 cents go into a brokerage account and buy some Starbucks stock? Now you can do that if you have the right app! Round up all of your bank or credit card transactions to the nearest dollar and save all those cents in a brokerage account. One it gets to $25 (or whatever amount you chose) have that cash purchase fractional shares of your favorite companies.